Overview of Digital Banking System Architecture

- Peter Johnson

- Jan 8, 2024

- 5 min read

This article will uncover the unseen infrastructure responsible for your online banking activities. We'll avoid confusing technical terminology and complex diagrams — instead, providing you with a simplified view of the systems that keep your finances running smoothly.

Picture a digital banking system like a bustling city. You can access your accounts through modern high-rise structures (front-end apps), cooperatively linked through invisible networks (middleware) to teeming marketplaces (back-end systems) where the financial sorcery takes place. These marketplaces are responsible for preserving your money as well as managing payments, all directed by keen traffic signals (APIs) to make sure things flow smoothly.

This is important to appreciate because understanding this conceptual architecture is comparable to possessing a city map. With it, you'll be able to move through the city with assurance, understanding precisely where to locate particular services (such as transferring funds) as well as being aware of the invisible support keeping everything running.

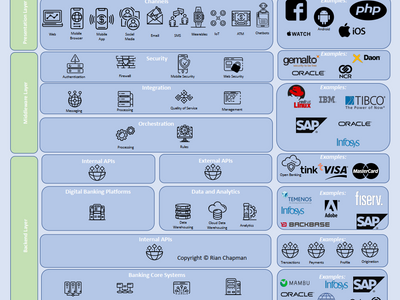

It's not necessary for diagrammatic depictions or to name particular software. We are discussing the core building blocks: the presentation layer, the concealed engines, and middleware which maintains their coordination. This simplified comprehension enables digital banking to do its magic (see the image below).

Contemplate the disorientation of being lost in this city, feeling confused and overwhelmed and unable to find your bank. Our map will give you assurance: you'll be able to move around and locate what you need, recognizing the unrecognized services keeping the city in motion, and even lend a helping hand to others in the same situation.

Subsequently, we'll scrutinise these tiers more closely, examining how they collaborate to manufacture a straightforward online banking experience. Let's get ready to witness this invisible city come to life!

These digital platforms - including web, mobile, and SMS - and the Internet of Things (IoT) can all be accessed here.

Digital banking is not exclusively about digital channels; you can find a human channel here too in the form of frontline bankers or other support personnel prepared to help people with their digital banking requirements.

The presentation layer includes various logic levels, such as presentation logic and business logic. This is where the programming for apps, like an Android mobile banking app, is stored and delivered to each end user's device.

Assuming the presentation layer has logic for this diagram, the next article will focus on the presentation layer, specifically front ends for mobile banking apps, in order to further explain how front ends and presentation layers work.

This layer consists of three integral sublayers: security, integration, and orchestration.

The authentication sublayer grants customers access to banking apps and websites upon successful validation of their credentials, such as a PIN or password. If the information input by the customer does not match that stored on file, access is denied.

Banks utilize firewall technologies much like on personal computers. As they deal with a huge amount of incoming connections, security measures are needed to allow appropriate traffic while barring malicious activities. Since banks hold substantial funds and provide worldwide payment systems, they become vulnerable to cyberattacks. It is therefore essential that they have strong security.

Banks are faced with the challenge of defending against customers whose devices have been infected with malware, keystroke loggers, or other malicious programs. If such devices were to interact with the bank's systems, a severe attack on the banking infrastructure could result, possibly creating systemic problems which would be detrimental to depositors and the global payment system as a whole. Consequently, banks must take stringent security measures in order to maintain the safety of their customers' funds and the integrity of the financial system.

This sublayer works as an intermediary, taking in requests from external systems, deciphering them, and relaying them to back-end systems in the applicable formats. It guarantees accurate syntax, protocols, and service levels to ensure that communications can be processed without a hitch.

The sublayer in question receives requests which have been translated from integration and performs associated actions such as retrieving customer data or processing payments. It essentially serves as the central nervous system of the architecture, in charge of coordinating activity.

This layer consists of four major components - APIs, digital banking platforms, Data & Analytics, and Core Banking Systems.

APIs function as a conduit for requesting data or activities between systems. The bank has both internal and external APIs, which connect to outside systems. APIs have a starting endpoint which accepts requests, and a processing endpoint which takes care of the requests and brings back responses.

The initial endpoint serves as the starting point for the orchestration sublayer to initiate a request. This request is then processed and the response sent back to the orchestration sublayer from the final endpoint.

For example, when a customer looks at a transaction detail in their banking app, the orchestration sublayer sends a request to the initiation endpoint API. This is then passed on to the transactions system to get the data, which is subsequently gone through the API pipe's ending endpoint and the answer is returned to the orchestration sublayer for display in the app. Core internal APIs make possible services such as payments, balances, alerts, etc.

This platform brings together the bank's products and services and packages them into services that internal APIs can access. It links customer-facing platforms to the core systems. Additionally, it takes care of data and analytics connected to digital banking usage in order to grasp customer behaviours.

Reference data, transaction data, and analytics are utilized to operate digital banking platforms and identify customer activity patterns. This is what enables the personalization and functionality of digital banking services.

The crux of banking activities is comprised of these systems, such as accounts, transactions, payments, accounting, interest computations, and the like.

Core banking systems are exceptionally intricate due to having been established bit by bit over the years. Their interconnectedness is so intricate that it has been likened by banks to a “spaghetti tree” structure. Astonishingly, numerous international banks continue to depend on mainframe systems which were implanted in the 1970s-80s.

Although a real bank system diagram may use a large whiteboard, this reference architecture briefly outlines the key elements of digital banking.

We have mapped out the key components of digital banking that enable a hassle-free user experience for customers. This is akin to an invisible city that allows its residents to transition through complex financial services smoothly.

We created Front-End "skyscrapers" and Back-End "markets" working together, along with middleware "transit networks" linking the two. Having an understanding of this structure gives you a clear direction, like following a roadmap to your destination.

Now, your understanding of the complexities behind your digital banking experience has increased. This brief look was an attempt to make clear the intricate coordination that is behind creating a simple user experience. Security procedures and old mainframes are just a few of the elements that help make it all possible.

Advance your knowledge of Digital Banking with the Digital Banking series that I offer!

Comments