Transforming Banking with Microservices and Cloud Architecture: Building the Bank of the Future

- Peter Johnson

- Jan 1, 2024

- 4 min read

Like ancient stone sentinels standing watch over treasured artifacts, banks have been unchanging in their grandiose spaces, their systems embedding the marks of age. Yet a digital sunrise illuminates the sky, and customers, no longer contented with merely reflections on the wall, crave the bright glow. In response, the rallying cry for a “Bank of the Future” has been issued, its construction rooted in the furnace of microservices and cloud, ready to rewrite the parameters of finance.

For generations, banks have struggled with their outdated core systems, based on outdated technology, that could not keep up with new features. Updates posed a challenge, and required considerable effort, downtime, and stifled any opportunities for innovation. The dawn of the digital age has necessitated a greater degree of agility, however, these clunky remainders are no longer capable of keeping up.

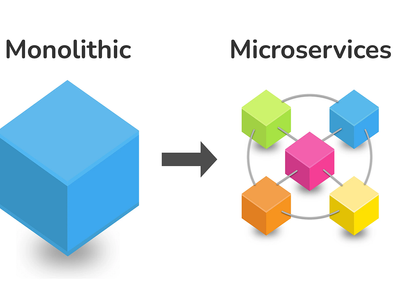

Say goodbye to bloated monoliths! Microservices are ushering in a new age, where banking capabilities are isolated into lightweight, stand-alone services. Each one is responsible for a particular activity (accounts, transactions, support) and, being loosely connected, can be shipped independently, like a fleet of nimble vessels sailing the digital ocean.

The modular architecture provides multiple benefits:

The merging of microservices with cloud architecture brings banking to unprecedented levels. By utilizing cloud platforms where resources are readily available and scalability is elastic, together with the dynamism of microservices, banking sector advantages include: user requests are broken down into smaller tasks, with each path customized according to the user’s choices.

Gone are the costly silos and rigid infrastructure of the past; microservices that are lean and autonomous have taken flight thanks to the cloud’s elastic capacity. Now, as user requests are divided into more streamlined tasks, the efficiency of a tailored user experience is in full swing.

A cultural transformation is necessary when transitioning to microservices, calling for agile teams instead of traditional structures. Careful planning and considering security measures are paramount for cloud migration, but the rewards for a bank are substantial, making it resilient, scalable, and able to meet customer requirements quickly.

A journey into the unknown awaits us on the journey to the “Bank of the Future.” To make this a reality, a culture shift is essential, one which celebrates decentralization and flexibility. Careful oversight of the cloud migration is essential to ensure the highest levels of safety are observed. The potential success is a tantalizing prospect; a bank that can actively respond to change and offer its customers infinite choice.

Exploring the trade-offs of microservices, which offer agility and innovation, is a must when considering embracing this architecture. Its potential negatives must be acknowledged.

Unleashing complexity: Discovering the intricacies of an intricate matter.

No Single Approach Suitable for Everyone

DBS Bank's Singapore headquarters serves as an ideal example of a bank leveraging microservices architecture. Realizing the importance of agility and innovation in the quickly changing financial sector, the bank began a journey to modernize its banking system.

DBS utilised microservices to divide its monolithic systems into smaller, more independent components. This modular architecture provided the organisation with the ability to rapidly meet customer needs and adapt to market fluctuations. Of particular note was the deployment of a microservice for customer onboarding, streamlining the account setup process. By taking this approach, DBS was able to implement this vital function with minimal interference to other existing services, as opposed to the traditional approach which would necessitate substantial modifications to the system.

The use of microservices allowed DBS to introduce new capabilities and services in a more detailed and productive way. This enabled them to seamlessly incorporate sophisticated technologies, such as AI-driven chatbots and customized financial management tools, into their online banking platform. Consequently, customers were provided with a more responsive and customised banking experience.

By integrating microservices with cloud architecture, DBS was able to gain scalability and flexibility. This enabled them to quickly adjust to varying levels of workload and guarantee customers a continuous digital banking experience. DBS Bank's successful incorporation of microservices makes it obvious how influential this construction approach can be, and serves as a source of motivation for other monetary establishments wishing to be successful in the modern digital world.

The reverberations of bygone days become muted as banking moves into a fresh epoch characterized by the fusion of microservices and cloud architecture. This powerful twosome brings more than just an alluring phrase; it presents unparalleled chances for growth, swiftness, and client-centricity.

The DBS Bank case study highlights the real value of microservices, yet we need to consider the flip side. The complexity of the operations, and the need for strong management, require a more tailored set-up. A one-stop approach won't get the job done.

For projects that are smaller or are focused on keeping things simple, monolithic architecture might still be the best choice. It is important to consider the specific factors of the project, such as size and team skills, when deciding which approach works best.

When the planets are in alignment, the consequence of individual services operating on the cloud creates an impressive performance. The antiquated and immobile giants of the past have been replaced. Banks, which were once constrained by their traditional systems, now access a flexible collection of resources and are capable of quickly adapting to customer needs with unfailing accuracy.

This integration is not just about modernizing technology; it's a sign that the banking sector is committed to progress. With the changing times of finance, microservices and cloud architecture serve as orchestrators of a future that ties efficiency, scalability, and a deep knowledge of the customer's demands.

Let the music ring out! The “Bank of the Future” is no longer just a dream of the future, but a song we can hear now, as microservices and cloud architecture give it a beat for a truly revolutionary show.

It is important to select the right architectural approach based on the context, given the far-reaching implications this transformation has for the banking industry as a whole. Careful consideration needs to be paid to ensure that the transition to the new approach is successful.

Comments