Uncovering Endless Payment Options

- Peter Johnson

- Jan 1, 2024

- 4 min read

Payoneer is a service that makes cross-border transactions simpler and more cost-effective. It offers a wide-ranging network of over 200 countries, allowing customers to exchange payments without difficulty and in various currencies. Furthermore, Payoneer implements licenses and regulations to ensure payments are efficiently executed.

Creating a strong and extendable system for Payoneer's international payment system that accounts for offline dealings, user input, uniformity, balance reconciliation, duplicate payment prevention, and optimized debt collection necessitates meticulous anticipation.

Join us as we demonstrate the comprehensive procedure for generating a powerful and successful system that is influencing the way worldwide payments operate.

The inherent difficulties of organizing a payment infrastructure are not to be underestimated. The numerous stages of the process, notably the need for approval, can lead to the transaction being drawn-out and offline. Pre-authorization can be difficult to attain, resulting in a more complicated system. Some payments necessitate user input, where foreign exchange/fee quotes need to be okayed, while for others this is not required.

It is imperative that atomicity be ensured in payment processes, as all transactions have to be either completely finished or entirely failed for the sake of preserving integrity. At times, the opportunity to reverse or withdraw a payment must be taken advantage of in order to fix errors or discrepancies. Another matter of concern is uniformity, as it is hard to establish consistent practices in generating payments and logs when multiple teams are keeping up their own payment mechanisms.

Reconciliation is an essential part of payment systems, particularly for situations in which fees are calculated based on past transactions rather than per transaction. It is important to ensure duplicate payments don't occur, as this can cause problems and financial discrepancies. Collecting debt can be a tricky process too, considering that the conventional infrastructure usually deposits the funds to the recipient prior to attempting to recover debts.

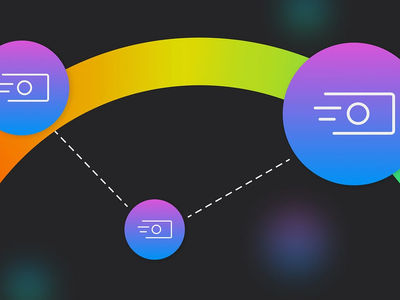

In regards to money transfers, Payoneer offers a variety of alternatives when it comes to sources and recipients of funds. These include credit cards, bank accounts, cards, eWallets, and more.

We should examine the necessary procedures of a Payoneer transaction more thoroughly.

In the initial stage, Payoneer makes certain that all the information necessary for the transaction to be successful is supplied.

Payoneer then routes the money, according to pre-established regulations, to determine which balance should be the recipient.

Once Payoneer has finished routing, it moves to construct the transactions. This activity involves translating the instructions provided into a complete transaction, such as calculating any applicable fees and foreign exchange (FX) rates.

Next, the pre-authorization process takes place, in which Payoneer holds the amount of the transfer to guarantee that the sender will have enough money once the other steps are completed. This gives both the sender and Payoneer peace of mind.

Every payment must pass through the approval stage in order to comply with risk and compliance regulations. This step guarantees the payment fulfills all of the necessary criteria and reduces any possible risks.

Payoneer makes sure that any debt that the receiver owes is collected prior to the funds being deposited into their account. This is done by conducting debt collection processes before the transaction is complete.

Last, the settlement stage finalizes the transaction. Payoneer deposits the transaction funds into the recipient's account, thereby executing the authorization that was made beforehand, finishing the whole procedure.

In addition to the primary steps, other considerations include creating logs, auditing, and offering the option of reversals if required.

Previously, separate teams had been managing each payment flow, which caused duplication of business logic, along with a lack of adaptability. This hindered bug fixing, feature implementation, and the development of new payment flows. In order to deal with these matters, Payoneer has altered its dynamic to simplify payment operations.

Payoneer enhances efficiency and reduces redundancies by consolidating payment flows and encouraging cross-functional collaboration. This strengthens their ability to adjust to changing payment situations and better serve their customers worldwide, while increasing development speed.

The alteration we enacted to our payments system is sufficiently fascinating to merit its own individualized blog.

Payoneer is revolutionizing how global payments are made, enabling individuals and organizations to execute cross-border transactions seamlessly. With its services available in over 200 countries, Payoneer is reducing expenses and eliminating the obstacles encountered with international transactions.

Payoneer provides a comprehensive payment system that addresses challenges ranging from offline transactions to ensuring atomicity, consistency, fee reconciliation, duplicate payments avoidance, and efficient debt collection. Its payment options cover a wide range of services including internal transactions, mass payouts, and bank withdrawals.

Payoneer provides a secure payment transfer process, from validation to settlement. Its ability to integrate payment streams, encourage collaboration, and improve efficiency demonstrates its commitment to evolving alongside the worldwide payments market.

We are shifting our payment infrastructure in a way that strategically streamlines operations, eliminates redundancies, and provides better service to a broad international customer base. This transformation marks a significant milestone for Payoneer, allowing us to stay competitive in the rapidly evolving world of global payments.

To sum up, Payoneer's dedication to achieving faultless transactions along with pioneering solutions presents a range of prospects. By persisting to advance, the business continues to be a pioneer in international trade, aiding both people and companies to be successful in the digital market.

Comments